8888970097: Why You Should Be Cautious With High-Yield Investments

High-yield investments attract many due to their potential for substantial returns. However, these opportunities often mask significant risks. Market volatility, scams, and the potential for substantial losses loom large. Investors must navigate these dangers with caution. Understanding the nuances of high-yield investments is crucial for success. What strategies can mitigate these risks, and how can investors safeguard their portfolios?

Understanding High-Yield Investments

High-yield investments, which typically offer returns significantly above the average market rate, attract a diverse range of investors seeking enhanced income potential.

Understanding yield calculations is crucial for evaluating the effectiveness of various investment strategies.

Common Risks Associated With High-Yield Investments

Investors seeking high returns must also consider the inherent risks associated with these opportunities.

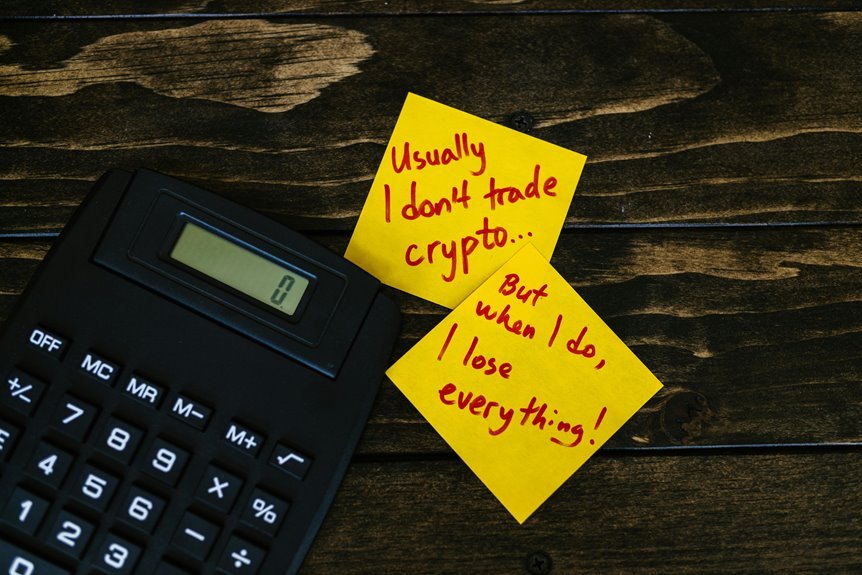

High-yield investments are often subject to market volatility, which can lead to significant losses. Additionally, the lure of high returns may attract investment scams, further complicating the landscape.

Understanding these risks is crucial for investors who wish to navigate the challenging terrain of high-yield opportunities effectively.

Tips for Making Informed Investment Decisions

How can one ensure that investment choices are both strategic and informed?

Implementing robust diversification strategies is essential, as it mitigates risk exposure across various assets.

Additionally, conducting thorough risk assessments allows investors to gauge potential downsides and adjust their portfolios accordingly.

Conclusion

In conclusion, while the allure of high-yield investments can be tempting, a careful approach is essential. Coincidentally, many investors who have pursued high returns without adequate research have encountered significant losses. By understanding the risks and employing diversification strategies, investors can navigate the complexities of high-yield opportunities more effectively. Ultimately, a balanced portfolio combined with informed decision-making can enhance both stability and potential success in the unpredictable landscape of high-yield investing.