4697296513: How to Maximize Your Stock Portfolio

Maximizing a stock portfolio requires a strategic approach that encompasses diversification, market analysis, and regular performance reviews. Investors should consider spreading their assets across various classes to reduce risk. Analyzing market trends through indicators like moving averages can provide insights into potential opportunities. However, the effectiveness of these strategies hinges on a consistent assessment process. Understanding how these elements interconnect may reveal critical insights for long-term financial success. What strategies will prove most effective in an ever-evolving market?

Diversifying Your Investments

While many investors may focus solely on high-performing stocks, diversifying investments across various asset classes is essential for mitigating risk and enhancing potential returns.

Effective risk assessment involves understanding market volatility and potential downturns. By employing strategic asset allocation, investors can spread exposure across equities, bonds, and alternative assets, thereby achieving a more balanced portfolio that aligns with their financial goals and risk tolerance.

Analyzing Market Trends

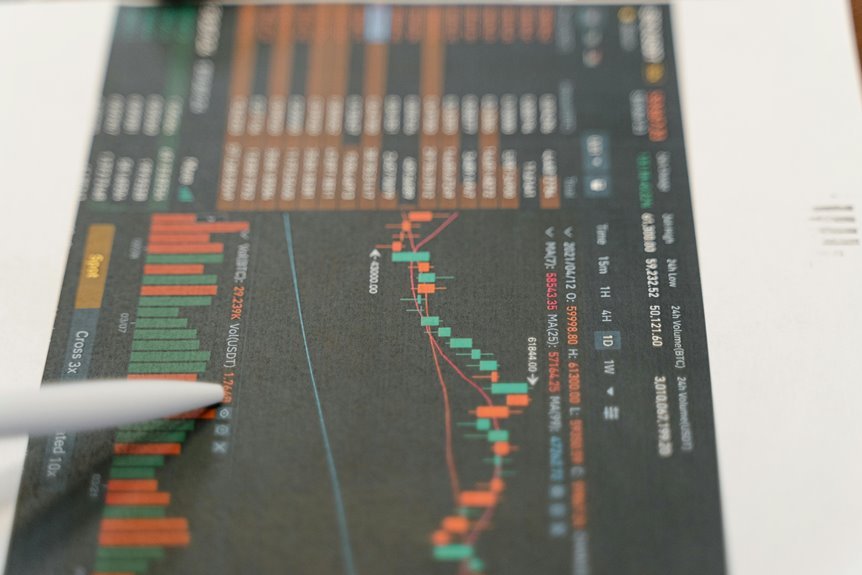

Understanding market trends is vital for investors looking to optimize their stock portfolios. Analyzing market indicators, such as moving averages and trading volumes, provides insight into potential future movements.

Evaluating historical performance helps identify patterns that may influence decision-making. By interpreting these trends, investors can make informed choices, adapting their strategies to maximize returns while maintaining the freedom to navigate the stock market effectively.

Implementing a Regular Review Process

How often should investors evaluate their stock portfolios to ensure optimal performance?

Establishing a regular review frequency is crucial for assessing performance metrics. Quarterly evaluations allow investors to adjust strategies based on changing market conditions and personal goals.

Conclusion

In summary, strategically synthesizing a diverse array of assets, consistently charting market changes, and committing to a comprehensive review regimen are crucial components for cultivating a robust stock portfolio. By embracing these essential elements, investors can effectively navigate the complexities of the market, mitigating risks while maximizing potential profits. Ultimately, a diligent and dynamic approach to portfolio management fosters financial fortitude and positions investors for sustained success in an ever-evolving economic landscape.